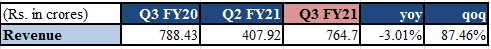

The company reported decent set of numbers, in line with expectations and exhibited recovery.

Industry Update

The RAC industry grew by 25% yoy as per the guidelines given by the management of Blue Star. The growth was aided by festive season sales, increase in e-commerce sale, affordable financing and positive business sentiment. Also, there was a stock up seen by the dealers on account of:

- Anticipation of good summers (Q4 is a seasonally good quarter for RAC industry)

- Input Costs have increased due to rise in commodity cost. Dealers purchased more in anticipation of hike in price.

- Positive business sentiments

Overall, the inventory levels across companies and trade channels have normalised.

Also, the AC Brands have undertaken a hike of 4-6% in Jan 2021.

In the Union Budget 2021, the government raised custom duty on compressors from 12.5% to 15%.

Result Update

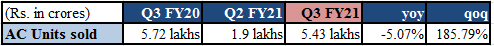

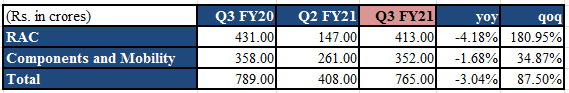

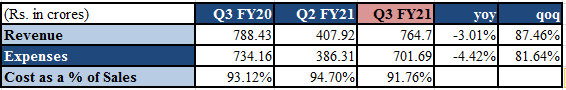

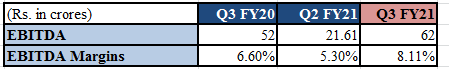

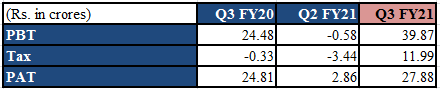

Amber’s revenue declined by 3.01% yoy on account of decrease in sales of subsidiaries (declined by ~15%) and higher channel inventories. This is expected to normalise in Q4 FY21. On the RAC front, the volumes remained flattish yoy and witnessed strong recovery qoq (increase by 2.8 times).

Components and Mobility Business

This segment reported a strong recovery qoq on account of addition of new clients and good demand from non AC components.

Subsidiaries

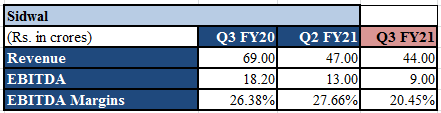

- Sidwal

However, the revenue from Sidwal decreased on account of slower execution in the Railways and Metros due to lockdown. However, post ease in lockdown, SIDWAL is expected to report good set of numbers as it has a healthy order book of Rs. ~400 crores that needs to be executed in next 2 years.

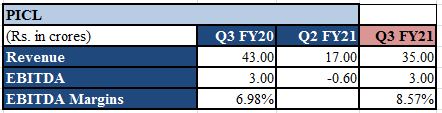

- PICL

There was a margin expansion seen in the current quarter (yoy). The company expects to double its revenue in PICL in next 2-3 years and expects a margin expansion on account of higher exports.

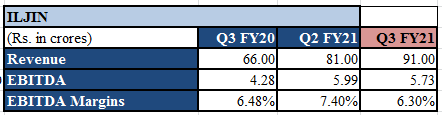

- ILJIN

The company added 4 new customers in ILJIN.

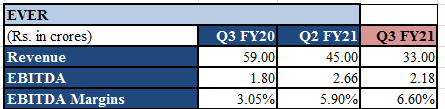

- EVER

- The company’s cost optimisation measures and better product mix resulted in operating efficiency during the quarter.

- Increase in volumes, better operating efficiency and decrease in finance costs improved the bottom line.

Non AC Components

- It contributes around ~20% in topline.

- Washing Machine- The company makes PCB Boards, injection moulds and motors which contributes to 25% of the total washing machine costs.

- Refrigerators- The company manufactures metal sheets, liners and board that contributes ~22-25% to the total cost of refrigerators.

Other Highlights

- After the ban on imports of RAC with refrigerants, the company added 6 new customers

- Net Debt of the company decreased to Rs. 263 crores from Rs. 343 in Dec 2019.

- The two new plants are expected to commence in Q4 FY2022. The capacity at Pune plant is expected to be around 1 million AC units.

- Amber also plans to do a JV for compressor business. It would require a capex of ~Rs. 250 crores for 2 million units.

Key Takeaways and drivers for growth

Going forward, Amber is expected to benefit from:

- Prohibition on import of air conditioners with refrigerants

- China +1 strategy and Aatmanirbhar Bharat (schemes initiated by government)

- Focusing on exports and component business

- New Expansions

- Rising share of Outsourcing as a theme

- Growing order book of Sidwal (high margin business)

Going forward, what are the concerns:

- Increase in commodity cost led to rise in input costs

There has been an impact of 5-7% on the price of finished RAC. This wouldn’t impact much to the new buyers. But, ACs purchased through consumer financing and replacements needs might see some resistance. As per the management, markets have taken time to digest such increase in price in the past. The company can pass on the price hike to customers and it’s visible as Amber’s customers have undertaken a hike in Jan 2021.

- Increase in custom duty on compressor from 12.5% to 15%.

In long term, this measure is good to boost domestic manufacturing and allow companies to set up facilities in India. But, in short term, I believe it might impact input cost because 80% of the compressors is imported in India. Only one company named Highli manufactures compressors in India. GMCC also plans to set up a plant but it got delayed due to COVID.

I believe, these are the two short term blips that can impact the volume.

Conclusion

The long term story looks intact considering the penetration of AC is very low in India. Overall, the government policies hit the right notes of increasing local and domestic manufacturing of the CBUs and components for RAC in India and the company being the market leader is expected to get the majority of the increasing pie. But, one needs to keep in mind the concerns mentioned above.

Please find the below link for pdf file on the same.

The Investing Tales- Amber Enterprise India Ltd. Q3 FY2021 Result Update

Disclaimer:

I am not a SEBI Registered Analyst. The views expressed therein are based on information available publicly/internal data/other reliable sources believed to be accurate. The information is provided merely for educational purpose only and in no way meant to be a stock recommendation.